salt tax deduction limit

Many of these same Democrats won their seats after launching aggressive attacks against Republicans for voting for the 2017 tax package that. House Democrats spending package raises the SALT deduction limit to 80000 through 2030.

How Did The Tcja Change The Amt Tax Policy Center

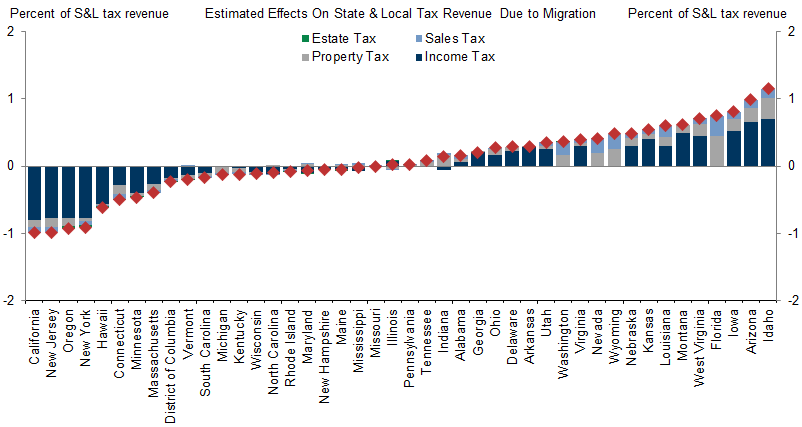

Removing the cap would reduce federal tax revenue by roughly more than 100 billion each year according to a 2019 analysis by the Tax Foundation a right-leaning think.

. This limit applies to single filers joint filers and heads of household. Generally you can take either a deduction or a tax credit for foreign income taxes imposed on you by a foreign country or a United States possession. The additional federal revenue helped pay for cuts to individual tax rates made by the bill.

To qualify for a home mortgage interest tax deduction homeowners must meet these two requirements. As an individual your deduction of state and local income sales and property taxes is limited to a combined total deduction of 10000 5000 if married filing separately. Self-employed people pay self-employment taxes which had them paying both halves of the tax.

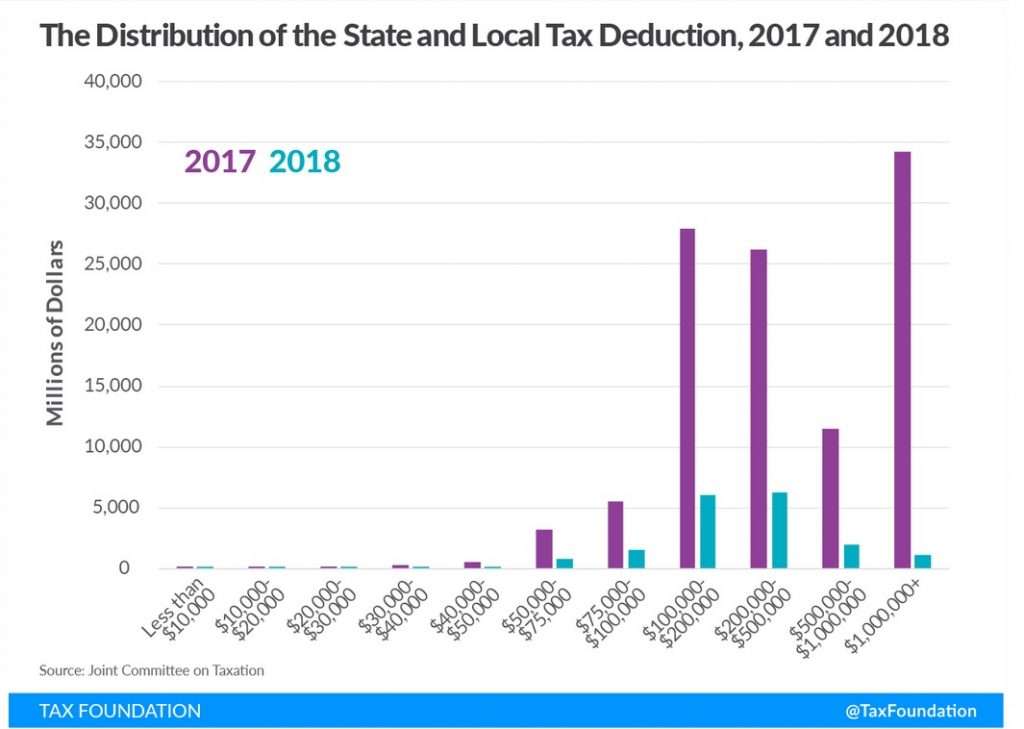

Beginning in 2018 the itemized deduction for state and local taxes paid will be capped at 10000 per return for single filers head of household filers and married. While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over how to reduce the tax break for the wealthy. This will leave some high-income filers with a higher tax bill.

For taxpayers who use married filing separate status the. The IRA tax deduction is different than other tax deductions. The state and local tax deduction commonly called the SALT deduction is a federal deduction that allows you to deduct the amount you pay in taxes to your state or local governments.

The 250000 limit still applies just as if they were still single. After 2017 you can only claim a 10000 deduction for state and local taxes halving your SALT deduction. Tom Suozzis defense of uncapping the 10000 state-and-local-tax deduction is all wrong Letters Aug.

The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018. So you need to have. As of 2019 the maximum SALT deduction is 10000.

22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. The Tax Cuts and Jobs Act TCJA enacted in December 2017 limited the itemized deduction for state and local taxes to 5000 for a married person filing a separate return and 10000 for all other tax filers. Gifts to charityline 19.

Remember how House Democrats from New Jersey and New York vowed to oppose a tax-and-spending bill that didnt lift the 10000 deduction limit for state-and-local taxes. The amount of home-sale profit that can be tax-free doubles from 250000 to 500000 once you are married. You can deduct these state and local taxes on your itemized federal return.

The limit is also important to know because the 2021 standard deduction is 12550 for single filers and 12950 in 2022. The SALT deduction was capped in 2017 with the passage of the Tax Cut and Jobs Act. Interest paidlines 10 11 12 and 13.

The 10000 mark is the combined deductible limit. You have until the April 15 tax deadline to make contributions for the previous tax year. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns.

This assumes that you own the house and have lived in it for at least two of the five years prior to the sale. The deduction has a cap of. In a post-Tax Cuts and Jobs Act world your taxable income is.

On his Presidential campaign Senator Joe Biden proposed also imposing the payroll tax on every dollar of income above 400000. The following Schedule A Form 1040 deductions are subject to the overall limit on itemized deductions. The change may be significant for filers who itemize deductions in high-tax states and currently can.

The cap applies to. Job expenses and certain miscellaneous deductionsline 27. The federal tax reform law passed on Dec.

The 10000 limit on SALT deductions has a significant. Other miscellaneous deductionsline 28 excluding gambling and casualty or theft losses. This is currently capped at 10000 per year for most taxpayers as a result of the Tax Cuts and Jobs Act.

For 2020 the FICA limit is on the first 137700 of income. A big itemized deduction for many taxpayers is the state and local taxes SALT deduction. But what if your spouse sold their house before the wedding.

The limit applies to tax years 2018 to 2025. Its not an issue of red states versus blue states.

Eat The Rich House Democrats Plan To Pass Huge Tax Break For Wealthy Homeowners

What Is The Salt Deduction H R Block

The Salt Deduction There S A Baffling Tax Gift To The Wealthy In The Democrats Social Spending Bill The Washington Post

How Did The Tcja Change The Amt Tax Policy Center

No Taxation Without Emigration Briggs

How Some Taxpayers Are Using Pass Through Entity Taxes To Avoid The Salt Cap Limit The Compardo Wienstroer Conrad Janes Team

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

How Some Taxpayers Are Using Pass Through Entity Taxes To Avoid The Salt Cap Limit The Compardo Wienstroer Conrad Janes Team

No Taxation Without Emigration Briggs

10 Spring Cleaning Hacks With Ingredients You Probably Already Have Infographic Ecogreenlove Spring Cleaning Hacks Cleaning Hacks Spring Cleaning

Avalara Automated Sales Tax Software Tax Software Automation Software

No Taxation Without Emigration Briggs

What Is The Salt Deduction H R Block

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Rx For High Salt Investors Municipal Bonds Envestnet Institute

Creating Racially And Economically Equitable Tax Policy In The South Itep

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

2022 Income Tax Brackets And The New Ideal Income For Max Happiness