philadelphia property tax rate 2019

Only a portion of the homes value is taxable. Unsure Of The Value Of Your Property.

1628 E Hewson St Philadelphia Pa 19125 Mls Paph833070 Redfin

How much are property taxes in Philadelphia.

. If no return is filed non-filer penalties are imposed. So residents were shocked last week to learn that the 51 homes on the 2500 block of South Mildred nearly doubled in value overnight on paper as the city rolled out new property assessments for 2019. Lets say you purchase a home thats worth 127300 and the abatement valueexempt value is 30000.

Philadelphia Property Tax. Youll only need to pay taxes on 97300 of the homes value. A return must be filed even if a loss is incurred.

Search Any Address 2. Taxing districts include Philadelphia county governments and various special districts such as public hospitals. Ad Enter Any Address Receive a Comprehensive Property Report.

Then receipts are distributed to these taxing authorities according to a predetermined plan. If you are eligible residents pay 33712 non-residents 29481. If you dont receive a tax package you are still responsible for filing a return and paying the tax due.

See Results in Minutes. Get a property tax abatement. Sexual health and family planning.

For example philadelphia was considering a 41 property tax increase for 2019. Philadelphia must follow stipulations of the New York Constitution in levying tax rates. Find All The Record Information You Need Here.

Coronavirus Disease 2019 COVID-19 Get services for an older adult. The property tax rate in Philadelphia is. Currently the Philadelphia property tax rate is 13998 and the Homestead Exemption is 45000.

Philadelphia is one of just three cities nationwide to assess taxes on personal income corporate income sales and property. As a freelancer Im a business Again wed. The citys current property tax rate is 13998 percent.

The median property tax in Pennsylvania is 222300 per year for a home worth the median value of 16470000. The City calculates your taxes using these numbers but can change both the Homestead Exemption amount and the tax rate. 06317 City 07681 School District 13998 Total The amount of Real Estate Tax you owe is determined by the value of your property as assessed by the Office of Property Assessment OPA.

Weve compiled the top five things every Philadelphia homeowner and prospective home buyer needs to know about their property taxes. Philadelphia County Pennsylvania has a typical property tax rate of 1236 per year for a home with a median value of 135200 and a median value of 135200. Together they add up to 202100 which when multiplied by 13998 totals 2829 in property taxes due for the year for this particular home.

135 of home value. For example although Pennsylvania has a 150 average effective property tax rate the rates on a county level vary from as little as 091 to as high as 246. Report a change to lot lines for your property taxes.

Tax amount varies by county. How much your home is assessed for plays a role in the amount of taxes youll pay. The City of Philadelphias tax rate schedule since 1952.

According to a more exact calculation the countys average effective property tax rate is 099 percent compared to the states average effective property tax rate of 150 percent. December 17 2021. 06317 goes to the city and 07681 goes to the school district.

Get Real Estate Tax relief. See Property Records Tax Titles Owner Info More. Philadelphia assesses property every year to determine market value based on numerous factors including the size.

Property Taxes on a Philadelphia Home Without Abatement. By David Murrell. The budgettax rate-determining process usually includes customary public hearings to discuss tax concerns and related budgetary considerations.

Tax bills for nearly half the blocks homeowners will jump from around 1000 to close to 2000 or more. The city of brotherly loves rate of 11 places it. Philadelphia assesses property at 100 of current market value.

We owed 731 in Net Profits Tax a business tax plus 5117 in penalties and interest. If you disagree with your property assessment you can file an appeal with the Board of Revision of Taxes BRT. Ad Be Your Own Property Detective.

Counties in Pennsylvania collect an average of 135 of a propertys assesed fair market value as property tax per year. Pennsylvania is ranked number sixteen out of the fifty states in order of the average amount of. Philadelphia property taxes are currently 13998 per year of your propertys assessed value.

Then in early July 2017 wed gotten another notice. Be aware that under state law taxpayers can elicit a vote on proposed rate increases that surpass set ceilings. There is a general property tax rate of 13998 for the whole county comprised of 06317 allocated to the city and 07681 allocated to schools.

The citys revaluation that took effect in 2019 saw a 105 increase in the median assessed value for a single-family home. There are three vital stages in taxing real estate ie devising tax rates estimating property market values and collecting receipts. The city of Philadelphia assesses property at its current market value which is 100 percent.

Search For Title Tax Pre-Foreclosure Info Today. Get information about property ownership value and physical characteristics. That increased by an additional 31 for the last reassessment which was completed in 2019 and used for 2020 and 2021 tax bills.

In 2020 youll see that the land is valued at 30315 and the improvements at 171785. The income-based rates are 05 lower than standard rates.

1922 Page St Philadelphia Pa 19121 Realtor Com

New Report Trends And Challenges In The Philadelphia Rental Market

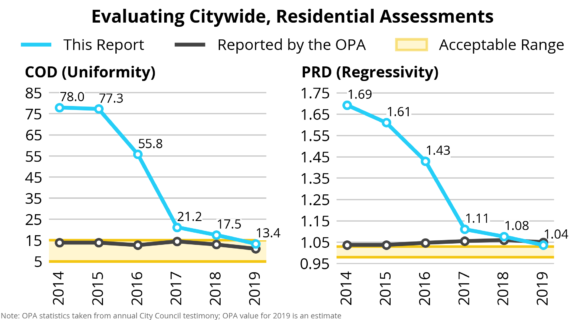

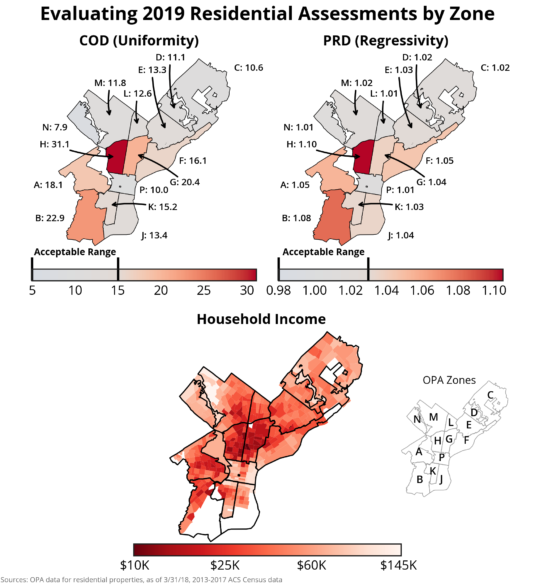

The Accuracy And Fairness Of Philadelphia S Property Assessments Office Of The Controller

Taxes Warwick Township Bucks County

Progress In Fight Against Poverty Lower Poverty Rate Higher Income Office Of The Mayor City Of Philadelphia

Henry Minton All That Philly Jazz

6109 Belden St Philadelphia Pa 19149 Mls Paph2001253 Redfin

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

1628 E Hewson St Philadelphia Pa 19125 Mls Paph833070 Redfin

3180 Miller St Philadelphia Pa 19134 Mls Paph2099266 Redfin

How The Tcja Reduced The Economic Benefits Of Homeownership Particularly In Counties With High Taxes

Keystone Opportunity Zones Programs And Initiatives City Of Philadelphia

4410 Van Kirk St Philadelphia Pa 19135 Realtor Com

4490 Richmond St Philadelphia Pa 19137 Realtor Com

New Community Driven Grant Program Available For Community Based Organizations Office Of Community Empowerment And Opportunity City Of Philadelphia

Philadelphia Residents Report Grim State Of City 2 Years Into Pandemic Philadelphia Business Journal

The Accuracy And Fairness Of Philadelphia S Property Assessments Office Of The Controller